Would you talk with someone in our company regarding any issues? Just drop us a line!

Table of Contents

- 1 Introduction

- 2 What is a Swiss Verein?

- 3 Why choose a Swiss Association?

- 4 Swiss Verein structure explained

- 5 Registration of an Association in Switzerland

- 6 Costs of forming a Swiss Verein

- 7 Taxation of a Swiss Association

- 8 Statistics and practice

- 9 Compliance and reporting

- 10 Key takeaways for decision makers

- 11 FAQ on Swiss Verein and Associations in Switzerland

Swiss Verein — everything about Associations in Switzerland

Switzerland is known not only for its banking system and neutrality but also for its legal flexibility. Among the many structures available to entrepreneurs, NGOs, and professional organisations, the Swiss Verein has a special place. This form of association is one of the most widely used legal vehicles in the country, ranging from small cultural clubs to large international law firms. It combines simplicity of formation with strong recognition under Swiss law.

The concept of a Swiss Association is firmly embedded in the Swiss Civil Code (Zivilgesetzbuch, Art. 60–79). It allows two or more persons to join together for a common purpose without the administrative burden of a corporation. For businesses and professionals abroad, the Swiss Verein structure offers unique advantages: it provides a legally independent framework with no minimum capital, flexible governance, and the potential for tax exemption if dedicated to a non-profit purpose.

This article explores the essential aspects of an Association in Switzerland. It covers legal foundations, registration procedures, costs, taxation, compliance requirements, and practical applications. Readers will also find comparative data, tables with cantonal fees, expert tips, and insights based on Swiss official sources such as the Federal Statistical Office (BFS), Handelsregister (Commercial Register), and ESTV (Swiss Federal Tax Administration).

What is a Swiss Verein?

Legal definition under the Swiss Civil Code

Under Art. 60 of the Swiss Civil Code (ZGB), a Verein (association) is a group of persons or entities united by bylaws to pursue a common non-commercial or commercial purpose. The law requires only two persons and written bylaws to establish a Swiss Association. Unlike corporations such as GmbH or AG, a Verein does not require share capital.

Private clubs vs. commercial associations

Most Swiss Vereine are cultural or social clubs — from alpine hiking groups to music societies. However, international business has adopted the Swiss Verein structure because of its flexibility. Global law firms and accounting firms frequently use it to unite independent offices worldwide under a common brand while keeping liability separate.

Why choose a Swiss Association?

Benefits for law firms, corporates, and NGOs

- No capital requirement: entry is possible without CHF 20,000 (GmbH) or CHF 100,000 (AG).

- Limited liability: members are not personally liable unless bylaws state otherwise.

- Flexible governance: the General Assembly and Board can be tailored in bylaws.

- International use: the Swiss Verein is recognised in court decisions and legal doctrine, offering certainty to multinationals.

Common use cases

- Professional networks (law firms, audit firms).

- Non-profit organisations and charities.

- Trade associations and lobbying groups.

- Sports and cultural clubs.

Apply for tax exemption only if the Verein has a genuine public-benefit purpose (education, charity, culture). Cantonal Steueramt authorities require clear proof of non-profit character.

Swiss Verein structure explained

Members, General Assembly, and Board

Every Verein must have members, a General Assembly (the supreme body), and a Board of Directors (Vorstand). The bylaws define rights, voting rules, and decision-making.

Liability and asset separation

Assets of the Verein are legally separate from those of its members. Creditors of the Verein cannot pursue members’ private assets unless explicitly agreed in bylaws.

Tax implications

A Verein is taxable under ordinary rules if it engages in commercial activities. However, it may be fully exempt from federal and cantonal taxes if it operates exclusively for charitable or public purposes, according to guidelines of the ESTV and cantonal tax authorities.

Registration of an Association in Switzerland

Minimum requirements

Minimum requirements

- Two or more persons (individuals or legal entities).

- Written bylaws (Statuten) stating name, purpose, governance, and membership rules.

- A General Assembly as the supreme body.

Handelsregister entry

Registration in the Commercial Register (Handelsregister) is mandatory if the Verein conducts a business enterprise or is subject to auditing. Many small cultural Vereine remain unregistered.

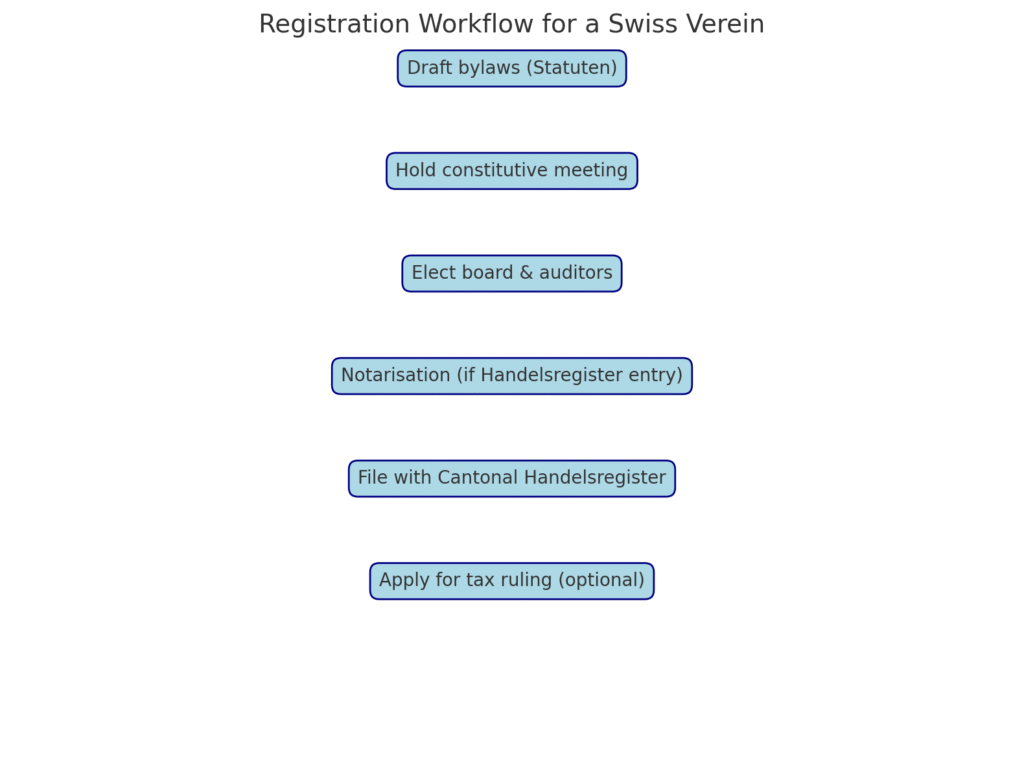

Timeline of registration steps

Below is a practical checklist for forming a Verein:

| Step | Action | Responsible Party |

| 1 | Draft bylaws (Statuten) | Founders / lawyer |

| 2 | Constitutive meeting | Members |

| 3 | Elect board and auditors (if required) | General Assembly |

| 4 | Notarisation (if Handelsregister entry) | Notary |

| 5 | Register with cantonal Handelsregister | Founders |

| 6 | Apply for tax ruling (optional) | Verein board |

Costs of forming a Swiss Verein

Notarial fees and drafting bylaws

- Drafting bylaws by a lawyer: CHF 1,000–3,000

- Notarisation (only if Handelsregister entry): CHF 500–1,000

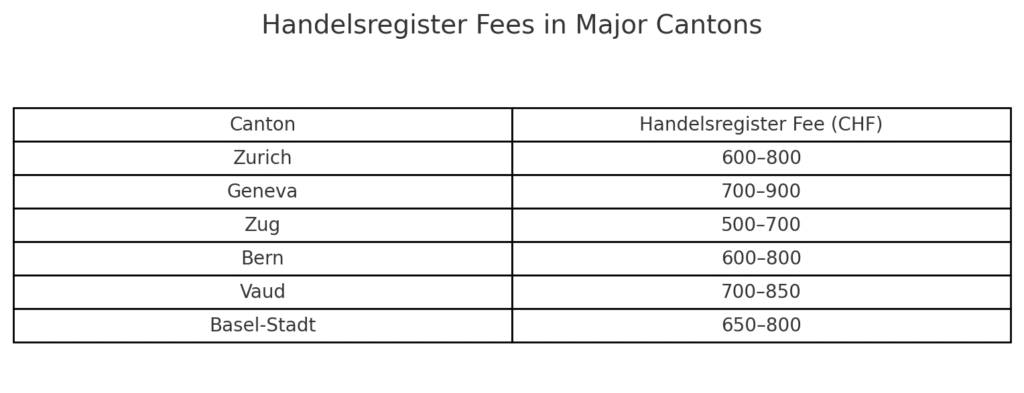

Handelsregister fees by canton

Cantonal Commercial Registers publish official tariffs. Fees vary depending on whether electronic filing is possible.

Table: Registration fees in major cantons

| Canton | Handelsregister Fee (CHF) | Notes |

| Zurich | 600–800 | Includes publication in SHAB |

| Geneva | 700–900 | French-language filing |

| Zug | 500–700 | Often chosen for international associations |

| Bern | 600–800 | German-language filing |

| Vaud | 700–850 | French-language filing |

| Basel-Stadt | 650–800 | Includes VAT |

Typical overall expenses

Table: Typical expenses for Swiss Verein formation

| Item | Cost Range (CHF) |

| Legal drafting of bylaws | 1,000–3,000 |

| Notarisation | 500–1,000 |

| Handelsregister fee | 500–900 |

| Translations (if needed) | 500–1,500 |

| Total | 2,500–6,500 |

Always budget for translation into German or French. Handelsregister accepts only official languages of the canton, which often requires certified translations.

Would you talk with someone in our company regarding any issues? Just drop us a line!

Taxation of a Swiss Association

Full taxation vs. exemption

- Taxable Verein: subject to corporate income tax (federal and cantonal), withholding tax on distributions.

- Tax-exempt Verein: if its purpose is exclusively public benefit, it may obtain exemption from income and capital taxes under Art. 56 lit. g DBG (federal law).

Application for tax exemption

The Verein must submit bylaws, activity plans, and financial projections to the cantonal Steueramt. Authorities examine whether profits are reinvested into the purpose and not distributed.

Table: Verein taxable vs. tax-exempt

| Criterion | Taxable Verein | Tax-exempt Verein |

| Purpose | Commercial | Public benefit |

| Tax liability | Full (federal + cantonal) | Exempt |

| Reporting | Standard corporate tax returns | Simplified |

| Donations | Not deductible | Deductible for donors |

In some cases, remaining taxable provides greater freedom for commercial activities, such as consulting or licensing. Exemption is beneficial only if the Verein truly serves a non-profit mission.

Statistics and practice

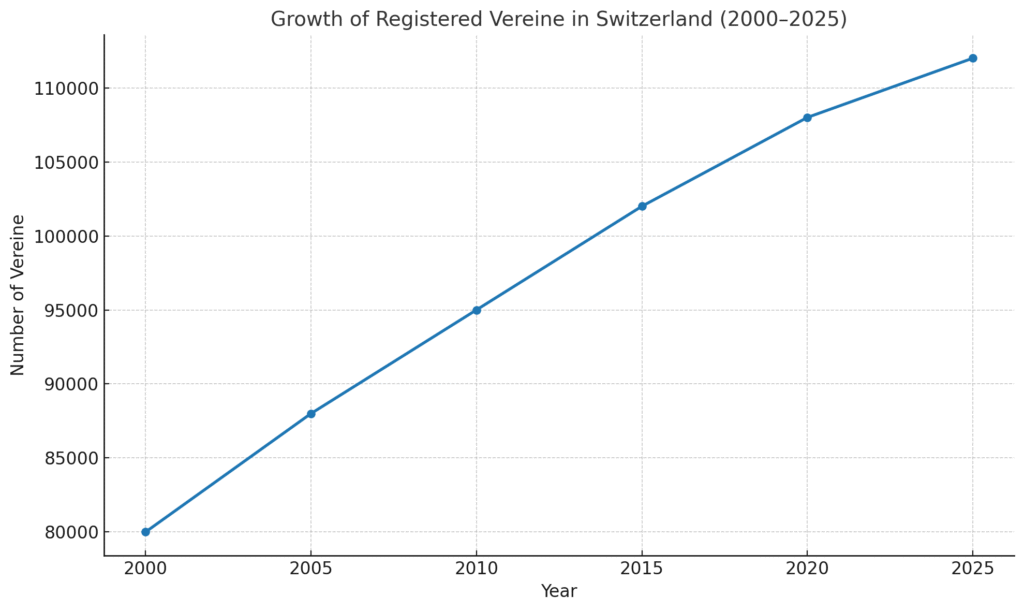

Number of registered Vereine

According to the Federal Statistical Office (BFS), Switzerland has more than 100,000 registered Vereine, with steady growth since 2000.

Infographic idea: A line chart showing growth from approx. 80,000 in 2000 to 110,000+ in 2025.

Typical industries and sectors

- Professional services (law, accounting)

- Sports federations

- Cultural and charitable organisations

- International umbrella associations

Compliance and reporting

Obligations after registration

- Maintain member register and bylaws.

- Hold annual General Assembly.

- Keep accounts; audit is required only if turnover exceeds thresholds (CHF 500,000+).

Governance best practices

- Transparent bylaws.

- Independent audit for larger Vereine.

- Regular reporting to members.

Table: Compliance obligations

| Requirement | Small Verein | Large Verein (auditable) |

| Annual Assembly | Yes | Yes |

| Accounts | Simple records | Full accounting |

| Audit | Optional | Mandatory |

| Filing with Handelsregister | Only if commercial | Yes |

Key takeaways for decision makers

Who should choose a Verein?

- International firms needing flexible brand integration.

- NGOs seeking recognition and tax exemption.

- Professional bodies uniting members across borders.

Checklist before registration

- Define purpose clearly.

- Draft bylaws professionally.

- Decide on Handelsregister entry.

- Assess tax position early.

Would you talk with someone in our company regarding any issues? Just drop us a line!

FAQs

A Swiss Verein is a legal entity under the Swiss Civil Code (Art. 60–79 ZGB) that allows two or more persons to form an Association in Switzerland for a common purpose. It requires only written bylaws and has no minimum capital requirement.

A Swiss Association does not require capital and is easier to establish than an AG or GmbH. Unlike a foundation, it is member-driven and governed by a General Assembly and Board.

No, registration is required only if the Verein operates a commercial business or must undergo audits. Many small cultural and social associations remain unregistered.

At least two members, written bylaws (Statuten), a General Assembly, and a Board are required.

The Swiss Verein structure consists of members, the General Assembly (supreme body), and a Board. Larger Vereine may appoint auditors.

Typical costs include CHF 2,500–6,500 for drafting bylaws, notarisation, Handelsregister fees, and translations. Cantonal Commercial Register fees range from CHF 500 to CHF 900.

Yes, a Verein may apply for tax exemption with the cantonal Steueramt if it pursues a public-benefit purpose such as charity, education, or culture.

If the association engages in significant commercial activities, remaining taxable may be preferable to avoid restrictions imposed on exempt organisations.

According to the Federal Statistical Office (BFS), Switzerland has over 100,000 registered Vereine, with continuous growth since 2000.

Filing must be in the official language of the canton (German, French, or Italian). This often requires certified translations of bylaws.

No, members are not personally liable unless explicitly stated in the bylaws. The Verein’s assets are separate from members’ personal property.

International law firms, NGOs, sports federations, and trade associations use this structure to unify operations under a recognised legal form with limited liability.

Minimum requirements

Minimum requirements